The Main Principles Of G. Halsey Wickser, Loan Agent

Table of ContentsExcitement About G. Halsey Wickser, Loan AgentThe smart Trick of G. Halsey Wickser, Loan Agent That Nobody is DiscussingThe Basic Principles Of G. Halsey Wickser, Loan Agent The smart Trick of G. Halsey Wickser, Loan Agent That Nobody is Talking AboutFascination About G. Halsey Wickser, Loan Agent

The Assistance from a mortgage broker does not finish once your mortgage is secured. They give continuous assistance, assisting you with any questions or issues that emerge throughout the life of your finance - california loan officer. This follow-up assistance makes certain that you remain completely satisfied with your mortgage and can make educated choices if your financial scenario changesSince they function with numerous lenders, brokers can discover a financing item that suits your special economic situation, even if you have been denied by a financial institution. This adaptability can be the trick to opening your desire for homeownership. Choosing to collaborate with a mortgage consultant can transform your home-buying journey, making it smoother, quicker, and a lot more monetarily advantageous.

Discovering the ideal home for on your own and finding out your budget can be extremely demanding, time, and money-consuming - california mortgage brokers. It asks a whole lot from you, diminishing your power as this task can be a job. (https://www.ted.com/profiles/48032877) A person who acts as an intermediary between a borrower a person seeking a mortgage or mortgage and a loan provider usually a financial institution or cooperative credit union

The Buzz on G. Halsey Wickser, Loan Agent

Their high level of experience to the table, which can be important in helping you make educated decisions and ultimately attain effective home funding. With passion rates varying and the ever-evolving market, having actually somebody fully listened to its ongoings would make your mortgage-seeking procedure a lot easier, alleviating you from browsing the struggles of filling in documents and carrying out heaps of study.

This allows them offer skilled advice on the best time to protect a home mortgage. Due to their experience, they also have actually developed links with a large network of loan providers, varying from significant banks to specific home loan service providers.

With their market understanding and capacity to bargain effectively, home loan brokers play an essential duty in safeguarding the most effective mortgage deals for their clients. By maintaining relationships with a diverse network of lenders, home loan brokers acquire access to a number of home loan choices. Moreover, their heightened experience, described above, can supply invaluable information.

G. Halsey Wickser, Loan Agent Things To Know Before You Get This

They possess the abilities and methods to persuade lenders to provide far better terms. This may consist of lower passion prices, lowered closing prices, or also much more adaptable payment schedules (mortgage loan officer california). A well-prepared home mortgage broker can provide your application and economic profile in a way that allures to loan providers, raising your possibilities of a successful negotiation

This advantage is frequently a pleasant surprise for several homebuyers, as it enables them to utilize the expertise and resources of a home mortgage broker without worrying regarding sustaining added expenses. When a debtor safeguards a mortgage with a broker, the lending institution compensates the broker with a compensation. This commission is a percentage of the loan amount and is commonly based upon elements such as the interest price and the kind of funding.

:max_bytes(150000):strip_icc()/advantages-and-disadvantages-of-using-a-mortgage-broker-17b1bf1df38947c3a7e74db2866dfb5f.jpg)

Home mortgage brokers master recognizing these distinctions and collaborating with loan providers to find a home mortgage that fits each debtor's specific requirements. This personalized strategy can make all the difference in your home-buying trip. By functioning closely with you, your home mortgage broker can guarantee that your lending terms align with your economic objectives and abilities.

Unknown Facts About G. Halsey Wickser, Loan Agent

Customized home mortgage options are the key to a successful and lasting homeownership experience, and mortgage brokers are the professionals who can make it occur. Working with a mortgage broker to function alongside you may bring about fast lending authorizations. By using their proficiency in this area, brokers can help you avoid prospective pitfalls that commonly trigger delays in loan authorization, causing a quicker and a lot more efficient course to protecting your home funding.

When it pertains to buying a home, browsing the globe of mortgages can be overwhelming. With so numerous options readily available, it can be testing to find the best car loan for your requirements. This is where a can be a valuable resource. Home mortgage brokers function as intermediaries between you and potential lending institutions, helping you find the very best mortgage offer tailored to your details circumstance.

Brokers are fluent in the complexities of the home loan industry and can offer valuable understandings that can assist you make educated choices. Rather than being restricted to the home loan products used by a single lender, mortgage brokers have accessibility to a broad network of loan providers. This indicates they can search on your behalf to discover the finest finance choices available, possibly conserving you time and cash.

This accessibility to several loan providers gives you a competitive benefit when it concerns safeguarding a desirable home loan. Searching for the right mortgage can be a taxing process. By dealing with a home loan broker, you can conserve effort and time by letting them deal with the research study and paperwork associated with searching for and protecting a financing.

The 10-Minute Rule for G. Halsey Wickser, Loan Agent

Unlike a bank lending police officer who may be managing several customers, a home mortgage broker can supply you with personalized solution tailored to your individual needs. They can make the effort to comprehend your monetary circumstance and goals, providing tailored solutions that straighten with your specific demands. Mortgage brokers are competent arbitrators that can help you safeguard the most effective possible terms on your car loan.

Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Dawn Wells Then & Now!

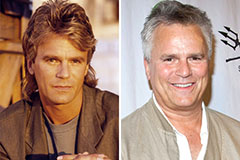

Dawn Wells Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!